by Melissa Dorn

The California Public Utilities Commission (CPUC) recently released a proposal that would require the major investor-owned utilities (IOUs) in the state to procure approximately 1.3 gigawatts (GWs) of energy storage by 2020. Consistent with state’s energy storage bill, Assembly Bill 2514, which passed in 2010, the CPUC’s proposal aims to reduce market barriers and incentivize development of viable, cost-effective energy storage methods. The CPUC hopes that the rapid growth of energy storage in California will support the state’s renewable energy industry as the state seeks to meet the legislature’s mandate to have one third of California’s energy generated from renewable sources by 2020. Many renewable energy sources are intermittent, making energy storage technologies important for the integration of a large quantity of renewable energy into the existing electric system.

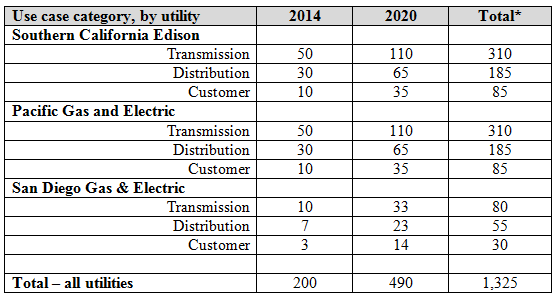

Central to the CPUC’s proposal are biannual procurement targets for the three major IOUs, Pacific Gas & Electric, Southern California Edison and San Diego Gas & Electric. The CPUC’s proposed aggregate procurement targets for each IOU are divided into three different “use cases” based on the end uses of the energy storage: transmission-connected storage systems, distribution-connected storage systems, and customer-sited storage systems. The initial proposed procurement targets are:

* The Totals include the additional interim targets for 2016 and 2018 that were intentionally omitted from this table.

To procure third-party owned energy storage to meet the targets, the CPUC proposed a “reverse auction” market mechanism, similar in structure to the state’s existing Renewable Auction Mechanism for renewable power sources. Under a reverse auction, energy storage providers would bid non-negotiable price bids, and the IOUs select projects starting with the lowest cost. The first auction, proposed for June of 2014, will require the IOUs to procure an aggregate 200 MW of storage. Subsequent auctions will be conducted every two years. The procurement targets are subject to change if the IOUs can demonstrate, among other things, that the energy storage resources bid into the reverse auction are not reasonable in cost, are not cost effective, or were insufficiently competitive.

The CPUC anticipates releasing its final order in October of this year.

read more

Subscribe

Subscribe